Read this When Does Navy Federal Report To The Credit Bureau article to find useful information for you, all summarized well by us.

When Does Navy Federal Report to the Credit Bureau?

As a responsible financial institution, Navy Federal Credit Union reports account activity to credit bureaus on a regular basis. Understanding when and how Navy Federal reports to the credit bureaus is crucial for managing your credit profile and making informed financial decisions.

In this article, we’ll delve into the details of Navy Federal’s credit reporting practices, explore recent trends and developments, and provide expert advice to help you navigate the credit reporting landscape.

Credit Reporting Overview

Credit bureaus are independent companies that collect and maintain credit information on individuals. This information, known as a credit report, includes details such as payment history, account balances, and inquiries. When you apply for credit, lenders typically obtain your credit report to assess your creditworthiness and determine your eligibility for loans or other financial products.

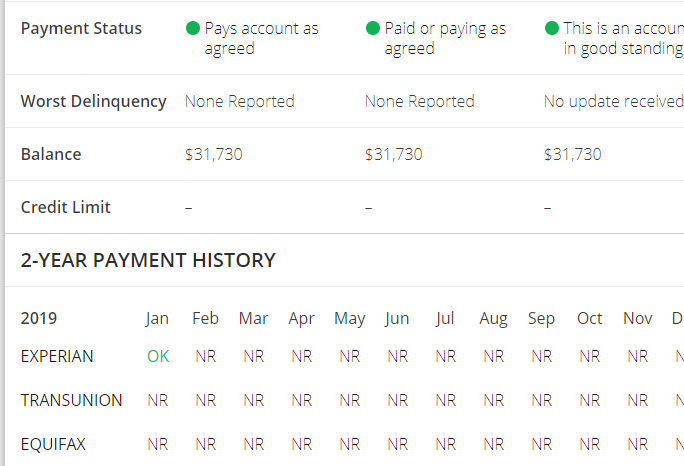

Navy Federal, like most financial institutions, reports account activity to the three major credit bureaus: Equifax, Experian, and TransUnion. By providing this information, Navy Federal helps maintain an accurate record of your credit history and enables lenders to make informed decisions.

Navy Federal’s Reporting Schedule

Navy Federal typically reports account activity to the credit bureaus on a monthly basis. This means that any updates to your account, such as payments made or balances owed, are usually reflected on your credit report within 30 days. However, it’s important to note that the exact timing of reporting may vary depending on factors such as account type and payment due dates.

If you make a late payment or experience any other negative events that could impact your credit score, it’s crucial to address the issue promptly. Contacting Navy Federal and working towards a resolution can help minimize the potential damage to your credit.

Latest Trends and Developments

In recent years, there have been several trends and developments in the credit reporting industry that are relevant to Navy Federal members. These include:

- Increased emphasis on timely payments: Credit bureaus are placing greater importance on timely payments as a key factor in determining credit scores.

- Expansion of credit reporting data: Credit bureaus are collecting and incorporating a wider range of data into credit reports, such as utility payments and rental history.

- Focus on consumer protection: Regulators are implementing new measures to protect consumers from inaccurate credit reporting and identity theft.

Tips for Managing Your Credit

To maintain a strong credit profile, it’s essential to follow these best practices:

- Make timely payments: Missing or late payments are the most significant factor in lowering your credit score. Set up automatic payments or reminders to avoid any missed deadlines.

- Keep your balances low: High credit utilization, which is the ratio of your balances to your available credit limits, can negatively impact your score.

- Monitor your credit report regularly: Obtain copies of your credit report from each of the three major bureaus and review them carefully for any errors or inaccuracies. Dispute any incorrect information promptly.

- Limit credit applications: Applying for too many credit products in a short period can trigger inquiries on your credit report, which can slightly lower your score.

By implementing these tips and understanding Navy Federal’s credit reporting practices, you can take control of your financial health and establish a strong credit profile.

Frequently Asked Questions

- Q: How often does Navy Federal report to the credit bureaus?

A: Navy Federal typically reports account activity to the credit bureaus on a monthly basis.

- Q: What information does Navy Federal report to the credit bureaus?

A: Navy Federal reports information such as payment history, account balances, and inquiries.

- Q: How can I obtain a copy of my credit report?

A: You can obtain free copies of your credit report from each of the three major credit bureaus once per year by visiting AnnualCreditReport.com.

- Q: What should I do if I find an error on my credit report?

A: Dispute any inaccurate information on your credit report directly with the credit bureau that provided the report.

Conclusion

Navy Federal’s credit reporting practices play a crucial role in maintaining the accuracy of your credit information and assisting lenders in making responsible lending decisions. By understanding the timing and scope of Navy Federal’s reporting, you can take proactive steps to manage your credit and build a strong financial foundation.

As you navigate the world of credit and financial management, seek guidance from reliable sources and consider consulting with a financial advisor or credit counselor for personalized advice. Remember, maintaining a healthy credit profile is an ongoing journey, and by staying informed and making responsible financial choices, you can achieve your financial goals.

If you have any questions or would like to learn more about Navy Federal’s credit reporting practices, we encourage you to reach out to the credit union directly or visit their website for further information.

Image: clinicinus.com

We express our gratitude for your visit to our site and for reading When Does Navy Federal Report To The Credit Bureau. We hope this article is beneficial for you.